Blog Archives

Happy Home Owners in Birmingham

Rick and Deborah Halbrooks have just bought a waterfront home in Birmingham’s Highland Lakes. Rick can’t wait to get out and see if the fish are biting…

We always appreciate getting notes from our Clients, like this latest one from Rick and Deborah Halbrooks. When we first spoke with Rick, he said something that really caught our attention: Rick said he had been living in the same house for over 40 years!

“You and Colleen did a wonderful job of representing us and earned every cent of your commission.

As a sales manager, it irritates me to have a sales rep get a big commission check when they don’t do much work; this was certainly not the case with you two.

You were always available, quick to research anything you didn’t know and answered our questions promptly.

You were available to meet us at the house on numerous occasions, made the arrangements, coordinated schedules and generally made us feel like we were the only customer you were working with (I know this was not the case — you are constantly juggling lots of deals).

We appreciate your efforts and for helping us make the only move in 42 (me)/31 (Deborah) years a pleasant experience.”

If you’re looking for a home for sale in the greater Birmingham/Shelby Co. Alabama area, give us a call.

We’re ready to help!

Spring Sales Update For Lake Forest

Looking for a home for sale in the general Birmingham, Alabama area?

Here’s an update we’ve produced on market activity in Lake Forest, a popular Shelby Co. neighborhood that’s an easy drive into downtown Birmingham:

Let us know if we can help…

USDA Pulls Back On Oct. 1st Loan Changes

Good news if you’re looking to buy a home in several areas close to Birmingham…

The U.S. Dep’t. of Agriculture has just announced that a previously planned October 1st change which would have meant the end of federal mortgage funding for two areas in Shelby Co. has been put on hold until late March of 2013.

This latest announcement means that Calera and Chelsea will remain on the list of communities eligible for Buyers to receive USDA funding on home mortgages, at least for another six months.

More than 90 communities nationwide—including Pleasant Grove in Jefferson Co. and areas in Walker and St. Clair counties—had been targeted to lose their eligibility, effective October 1st. Yesterday, however, Dallas Tonsager, USDA’s Under Secretary for Rural Development, issued a notice saying the changes would not take effect next week.

USDA loans are popular with many Buyers because they do not require down payments. They are available, however, only in areas USDA specifically designates.

As it stands now, the changes will take effect March 27, 2013 … unless USDA or Congress takes action in the meantime.

Big Changes Coming For Short Sales

Short sales—long dreaded by many Buyers and Sellers alike for taking so long to conclude—may just actually become shorter, after all.

The Federal Housing Finance Agency has just announced new rules designed to speed up the Short Sale process. In the Birmingham area, getting your home sold in a Short Sale can sometimes take 90 days or longer … but that time could wind up dropping in some cases.

Under the new guidelines, which take effect November 1st, if you own a home with a mortgage backed by either Fannie Mae or Freddie Mac, you’ll be able to sell your home in a Short Sale even if you are current on your payments, as long as you can prove a hardship.

The process of getting a Short Sale approved will be further streamlined, since, in some cases, mortgage servicers will no longer be required to gain additional approval from Fannie Mae or Freddie Mac.

Both entities will waive the right to pursue a deficiency judgement against borrowers who have sufficient income or assets if the borrower agrees to make a financial contribution or signs a promissory note.

If you have a second loan, the new rules authorize Fannie Mae and Freddie Mac to offer up to $6,000 to the second lien holder. This may help speed up getting a Short Sale through, too, since—in the past—the process has sometimes been bogged down by second lien holders negotiating for higher settlements.

In addition, borrowers who serve in the U.S. military and who are being relocated will automatically be eligible for Short Sale approval, even if they are current on their mortgages.

The changes, backed by the National Association of Realtors, are expected to make Short Sales a more viable option for many home owners who otherwise might have faced defaulting on their loans and being Foreclosed.

Calera and Chelsea to Lose USDA Loan Coverage

If you’re thinking of buying a home in Shelby County’s Calera or Chelsea area and are planning on financing your purchase with a no-down-payment USDA loan, you better get moving with your purchase, because time may be about to run out.

As of October first, the USDA is expected to update the areas that qualify for its loans. For Shelby Co., this means that Calera—which has long been a popular spot for home Buyers using USDA financing—will be dropped from the eligibility list. Chelsea is also set to be dropped.

In Walker Co., Jasper will be dropped from USDA loan eligibility, as will Moody and Pell City in St. Clair Co., and Pleasant Grove in Jefferson Co.

In all, more than 90 communities will be removed from the list of qualifying areas.

The change in qualifying areas is not a 100% sure thing. At least one U.S. Congressman—Republican Jeff Fortenberry of Nebraska—is pushing to get Congress to order a one year extension of USDA’s existing eligibility zones. Others pushing USDA to grant an extension include the National Association of Realtors, the National Association of Home Builders and the Mortgage Bankers Association.

Why does USDA plan to change the zones? The answer lies partly with the 2010 Census. An existing grandfathering clause allowed any community considered ‘rural’ in 1990 to continue to be eligible for USDA funding until the 2010 Census, as long as it has a population below 25,000 and met other critera. That clause, which was first enacted in 1990 and extended in 2000, is now set to expire.

So, unless Congress takes action, many communities that currently qualify for USDA financing will lose their eligibility—and for many of those areas, USDA loans are the only source of federal housing funding.

David

Are Birmingham Area Homes Selling?

From time to time, people ask us, “How’s business?”

If you look around and ask various Agents throughout the Birmingham area how their business is going, you’re likely to get varied answers. One Agent we spoke with recently has struggled much of the year. Other Agents we know have been doing much better. Colleen and I have had an extremely busy year, for which we’re grateful.

The fact is that—regardless of the economy in general and what’s reported in the news media—homes still sell. That’s because people’s lives change. New jobs, a change in family size or wanting to be closer to a particular area can be among the reasons.

I’ve heard people thinking of selling their home say, “I’ll wait until the economy improves.” To be sure, values are still down considerably, compared to previous years.

But that can also be like saying, “I’m going to buy a new car when the models get better.”

Here in the Birmingham and Shelby Co. area, the number of homes for sale in many communities is down considerably, compared to previous months. In Shelby County’s Alabaster and vicinity, the Birmingham MLS shows 220 homes for sale at present. This continues to be among the lowest numbers we’ve seen.

This drop in inventory is having an effect. Homes for sale that we consider excellent deals don’t stay on the market long. Buyers are out there, and pounce as soon as the excellent deals appear.

I’ve heard some home owners trying to sell without luck lamenting the lack of Buyers. It’s really not that Buyers are scarce. It’s just that they’re finding better deals elsewhere; the homes they wind up buying are in nicer condition, have more features, or are priced more attractively (or maybe all three).

A home needs to have pizazz to sell in the current market, and must be priced to grab a Buyer’s attention.

A home needs to have pizazz to sell in the current market, and must be priced to grab a Buyer’s attention.

Homes lacking these attributes typically take much longer to sell (we’ve seen homes remain on market over a year before getting an Offer).

When it comes to getting your home sold, there are definitely success stories in the Birmingham area. Colleen and I recently listed a home in Alabaster that got two Offers and went Under Contract 13 days after going on the market. The Seller was motivated, priced his home so that Buyers had to notice, and has done a lot of fixing up to make his home look nice. The payoff to his work is that his home is set to sell, so he can move.

The drop in inventory being seen in some areas around Birmingham is starting to put a bit of a squeeze on Buyers. The Buyer who sees a really good deal on a home for sale in this area now realizes that there’s a chance to be taken by waiting: Someone else might swoop in and grab the home in the meantime.

If you’re looking to buy a home in the area, our advice is to think about what’s important in a home to you, as well as area, and to contact us (205-356-5412). If you’re planning to get a loan, another critical step to take early in the process is to get in touch with a Lender. Here is a link to some area Lenders we recommend contacting.

Remember that the world of home mortgages can be confusing, because there are so many different kinds of loans and differences in fees, down payments and other charges. A good Lender will be able to sort this out for you to help to simplify your decision.

Getting quotes from other Lenders to compare is a good idea, too; just be sure to understand that comparing different loans effectively means looking at all the overall costs, and not just a single fee that might be higher with one loan. You might also ask about “locking” in your interest rate (which involves being assured of getting the same rate if you wind up buying a little later).

By following these steps, you’ll be on the road to being part of the home sales success stories we’re seeing throughout much of the Shelby Co. and Birmingham area.

David

Birmingham Home Sales Thoughts for 2012

As Fisbo,  our highly spoiled six pound poodle, and I took our early morning walk a few days ago, I used the time to contemplate how our real estate business has evolved during 2011 and thought about what’s ahead as we kick off 2012.

our highly spoiled six pound poodle, and I took our early morning walk a few days ago, I used the time to contemplate how our real estate business has evolved during 2011 and thought about what’s ahead as we kick off 2012.

Our walk was made rather intriguing because the neighborhood was shrouded in fog, limiting visibility sometimes to only a few hundred feet.

You can’t see very far ahead, and as you keep moving, what’s behind you grows increasingly vague.

Predicting home sale trends in Birmingham and Shelby County can be a little like walking into the fog: You can see a certain distance in front of you, but after that, knowing what’s ahead gets tricky.

That’s not to say we’re in a fog about what will happen, market-wise, during 2012. In fact, Colleen and I are optimistic that a lot of people will be buying and selling homes during ’12.

We think it’s going to be a busy and successful year.

Our optimism about ’12 is due in part to 2011, a year that was not only productive for us, but outperformed previous years.

For a lot of people in the Birmingham area, 2011 was a very difficult year, with the April 27th tornado affecting so many thousands of people and Jefferson County declaring the largest municipal bankruptcy in history.

I believe the new year will be one of healing and stories of success.

So, what does this mean for you if you’re thinking of buying or selling a home? Okay, watch out, I’m getting out the crystal ball!

If You’re Buying:

2012 will be a year of excellent opportunity.

You might have to spend a little more time picking and choosing than during previous years, because inventory in some areas has dropped. This doesn’t mean the good deals are gone. It just means you’ll have to do a little more work to find them. An Agent with a good knowledge of the market as well as sharp negotiating skills will be one of your most valuable assets during this time.

Pricing will continue to be very much in your favor, but if you’re in search of a “steal,” you stand a greater chance of a Seller saying, “no deal.” If inventory continues to drop, Sellers have less competition, and therefore less reason for agreeing to a “fire sale” Offer.

The Buyer who understands and accepts this still stands to get a very good deal.

With no sharp rise in mortgage interest rates on the horizon, ’12 is shaping up to be another year of tremendously low borrowing costs.

If You’re Selling:

You will be in a better position to get your home sold than in some previous years. Home values will continue to be a big challenge, but the news isn’t all bad. With the number of homes for sale dropping in some areas, what has been very much a Buyer’s Market shows signs of changing. That’s a good thing, but the change is going to be gradual.

During ’11, we saw many homes sell for the same price they sold for ten years earlier. This was great for the Buyer, but not for the Seller. Seeing both Buyer and Seller bring checks to the closing table was not uncommon last year.

If you plan to sell during ’12, understanding one “fact of life” about the Birmingham and Shelby Co. real estate market will help: The maximum a Buyer thinks your home is worth may wind up being significantly less than you had anticipated.

We do feel optimistic that the slide in values is beginning to ease. This easing, however, is likely to be so slow and so slight that many people selling in 2012 may not feel it’s very noticeable. It’s important to remember, though, that the slide in home values didn’t happen in a few weeks or months, but rather, took years. Any correction won’t happen fast, either.

And then there’s the matter of your home’s condition. Do you want your home to appeal to a majority of possible Buyers or only a few? In the Birmingham and Shelby Co. area, the overwhelming majority of Buyers we work with want homes that are immaculate, need nothing done, and are “move-in” ready. We do get calls from Buyers looking for places to fix up, but they expect to pay “bottom dollar” for the work they know they’ll have to do.

A 2011 High Point:

Of all the homes Colleen and I sold during 2011, one property we were particularly excited to sell was a home in Alabaster.

Price wise, this home was nowhere near our biggest sale. But it’s not about the money.

The Seller had tried to sell five times before, starting three years ago, and not had success.

This was a sizable home in extremely nice, clean condition. But the sales price had never been in alignment with what was taking place in the Shelby Co. market, and we didn’t feel that the property had been marketed correctly.

Lowering the price was not easy for the Seller to do. But we worked hard in marketing the property, and our Seller worked hard, too, cooperating closely with us as we moved toward our common goal.

That team work finally paid off with a successful closing.

It pays to be a student of the market. Many of the sales Colleen and I helped with here in the Birmingham area offer lessons to the wise if you’re thinking of selling during ’12.

A 2011 Low Point:

We had many successful sales last year. But one home we listed in No. Shelby Co. was not destined to be one of them. It stayed on market for five months and never received an Offer. The home was not priced correctly, drew very little interest, and had significant structural issues cited by many of the few Buyers who actually looked inside.

During one phone call, the Seller (who had moved out but was still making monthly payments) says, “I really need to sell this house.” Only seconds later—during the same conversation, as we discuss pricing—he says, “I’m not giving my house away.”

The Seller’s viewpoint could be summed up in five words: Take it or leave it.

Buyers gave their answer.

The experiences from both our High Point and Low Point provide clear support for a prediction we’ll make for the year, though it’s not the boldest call I could make: 2012 will show that price and condition have never been more important in getting your home sold.

Changes To The Dictionary:

As we kick off ’12, I’m also deciding that it’s time to change the definition of some of the terms real estate Agents use (hmmm … am I allowed to do that?).

Agents have long referred to motivated and unmotivated Sellers. These categories don’t exist any longer. A Seller who is determined to do what it takes to get their home sold is, by definition, motivated. They will adjust their price as needed and will make sure their home is immaculate (as so many folks we worked with did last year). These are the people who, in all likelihood, will get to sit at a closing table.

The unmotivated Seller is typically unwilling to price attractively enough to receive an Offer. They also choose not to deal with with the moldy smell in the basement or the rotted wood that needs to be replaced. This person is not a Seller. They are a home owner. If they do happen to receive an Offer, it is likely to be for an extremely low price.

This year will be another time of great opportunity in real estate. If you’re giving thought to buying or selling a home, you no doubt have questions. Whether you’re a veteran or just starting out, Colleen and I hope you will feel welcome to contact us for assistance.

Feel free to call us at 205.356.5412 or 205.677.8686. Or e-mail us at: sales@theblackteam.com

And we’re on Facebook, if you’d like to join us.

As for walking through the fog, I look forward to it. What might be ahead may not always be known, but if you’re determined to keep moving, the scene gets clearer as you forge onward.

Our optimism and positive thinking have us excited … we know there are lots of opportunities ahead.

We look forward to being part of your 2012 success story…

David

Branum’s Greystone Property: A Real Treat…

When Birmingham home builder Clayton Branum builds a home, he creates a first class product.

Colleen, Jeff De Shazo and I are thrilled to be helping Branum with marketing his own, personal home for sale. And what a home it is!

Check out the video we’ve just produced that takes you through this spectacular property in The Cove of Greystone…

More information about Branum’s home is available here, as well…

David

Alabaster Area Home Sales Rise in August

With summer behind us, here’s a look at home sales trends in the Alabaster, Maylene and Saginaw areas (stats from the Birmingham MLS):

After taking a dip in June, average sales prices are holding fairly steady:

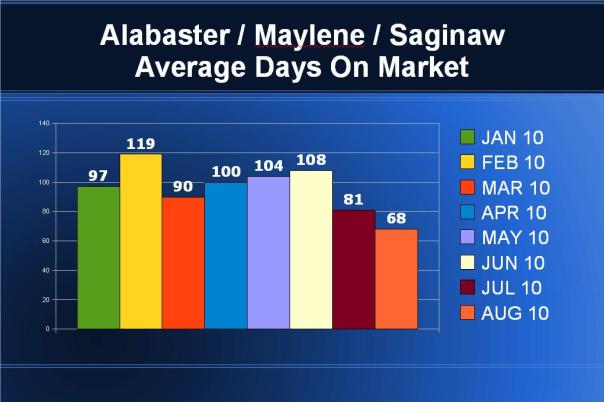

How long does it take to get a home sold in these areas? According to the MLS, the time needed is just a little over two months (the shortest it has been all year):

Right now, 354 conventional single family houses and townhomes are for sale in the Alabaster, Maylene and Saginaw areas. Of those:

289 are priced at or below $250,000;

127 are priced at or below $150,000;

22 are priced at or below $100,000;

338 have 3 or more bedrooms;

170 have 4 or more bedrooms;

29 have 5 or more bedrooms;

113 have pools or access to pools;

5 have 4 or more acres…

Need a loan to buy? Rates right now continue to be among the lowest in history. Qualified borrowers can get a 30-year fixed rate loan for as low as around 4.25%; 15-year fixed rate loans can be found by some borrowers as low as 3.75%. Colleen and I have been able to help a number of first time Buyers say ‘adios’ to renting and move into their first homes with some excellent loans at very low rates.

Needless to say, this continues to be a tremendous time to buy a home … let us know if we can help!

David

First Steps All Home Buyers Must Take

Mar 15

Posted by David Black

Walking on to a new car lot can be fun. You get to see all the latest technology and styling, and imagine yourself behind the wheel.

And then, after glancing at the sticker, reality sets in.

Looking was fun, but the sticker reminds that—before you can actually own that new car—you’re going to have to play the “show me the money” game.

Having your funding secured for the purchase of a new home is just as important. After all, if you don’t have the money needed to make buying a home a reality, what’s the point of looking?

Having enough money on hand to pay cash for a home is great, but let’s face it … not everyone can do this.

The alternative, then, is to get a loan.

Unfortunately, a number of people looking to buy a home in the Birmingham area wind up starting the loan process the wrong way, which goes like this:

The scenario above is a classic invitation to major Buyer disappointment.

It doesn’t have to happen this way.

Colleen and I feel strongly that the first–and most important–steps in the home buying process are to contact us as your Agents and then speak with a Lender.

By finding out how much money you can borrow before you start looking, your search will be easier, as well as more targeted to properties that fit within your price range. If there are parts of your financial background that need work, a Lender can be a good resource for charting a course for you to follow so you can be approved.

If you’re thinking of buying a home, a good Lender will answer all of your questions and make you feel comfortable with the entire process of obtaining financing. Since buying a home is the biggest purchase many people make, if you don’t have this feeling of comfort, our advice is simple: Find another Lender.

Buyers lacking some time of financial qualification may be in for a surprise, given a reality we see all the time in the Shelby Co. and Birmingham real estate market:

Sellers want some assurance that a prospective

Buyer can actually obtain needed funding.

“Show me the money.”

If you try submitting an Offer without including either a loan pre-qualification or verification of funds (if paying cash), many Sellers simply won’t deal with you.

We know of several good Lenders in the Birmingham area with a thorough knowledge of the mortgage profession, different loans, costs and how they work. These Lenders have a strong commitment to providing good service.

Fortunately, most of our Clients purchased their home the right way, having contacted us first and then following our advice on consulting with Lenders before we started helping them with their search.

As a result, they are now happy homeowners.

David

Posted in Commentary, Real Estate

Leave a comment

Tags: agent, alabama, birmingham, colleen black, david black, first time buyer, home for sale, homes, homes for sale, hoover, keller williams realty metro south, lender, loan, market, mortgage, Real Estate, realtor, shelby county