Blog Archives

Birmingham Area USDA Financing Ends

If you’re thinking of buying a home in several areas near Birmingham using 100% loan financing through the U.S. Department of Agriculture, you’ll have to go a different route.

Effective October 1st, homes in Chelsea, Calera, Moody and Pleasant Grove—areas that have been eligible for USDA’s no-down-payment funding—will no longer qualify.

Current loans that are already in USDA’s processing system as of October 1st will be honored.

The removal of these areas comes as a result of a decision that these communities are no longer considered rural.

USDA’s loan program has been very popular…Colleen and I have helped many first time Buyers over the years with purchasing a home using this financing.

This does not necessarily mean that you’re out of options if you’re trying to get a 100% financed loan for a home in these areas.

USDA’s no-down-payment financing for Calera, Chelsea, Moody and Pleasant Grove is winding down as of Oct 1st.

A new 100% conventional loan program has just been announced that may be a suitable alternative.

Offered by several area Lenders, the new loan program is currently available at a fixed rate of 4.75% to Buyers who qualify, and has reduced mortgage insurance. And, unlike USDA loans, this new loan is not restricted by area.

Here are a few Lenders in the area you can contact for more information:

KC Haririan

Aliant Bank

205-999-1386

Gloria Jackson

First Federal Mortgage

205-965-2167

Woody Woodfin

Home Mortgage of America, Inc.

205-229-2877

Birmingham Area Sales Update

Here’s a look at how many homes are for sale in some of the Birmingham area’s more desired neighborhoods, followed by lowest to highest asking price (data is provided by the Greater Alabama MLS, Inc.):

Shelby County, just south of the Birmingham metro area, is popular with many Buyers who realize how much home they can get for their money…

Birmingham:

Shoal Creek … 13 ($579,9K – $13,900,000)

Mt. Laurel … 14 ($240K – $699,9K)

Hoover:

Greystone … 112 ($149,9K – $6,900,000)

Greystone Ridge … 2 ($149,9K – $189K)

Greystone Legacy … 34 ($404,9K – $1,699,000)

Greystone Village … 1 ($259,9K)

Greystone Cove … 5 ($449K – $1,140,000)

Highland Lakes … 52 ($287,9K – $1,097,900)

Eagle Point … 11 ($184,9K – $675K)

Trace Crossings … 43 ($239,9K – $899K)

Lake Crest … 6 ($327,9K – $499,9)

Pelham:

Ballantrae … 46 ($179,9K – $899,9K)

High Hampton … 1 ($325K)

Mallard Pointe … 3 ($198,5K – $209,9K)

Helena:

Riverwoods … 8 ($229K – $400K)

Hillsboro … 4 ($193,9K – $264,9K)

With the number of homes having fallen in many communities around Birmingham, it’s not nearly so much of a Buyer’s market as it used to be…

Alabaster:

Sterling Gate … 4 ($129,7K – $214,9K)

Cedar Grove … 3 ($134,9K – $279,9K)

Grande View … 11 ($152,9K – $304,4K)

Wynlake … 2 ($199,9K – $379,9K)

Lake Forest … 7 ($152,K – $294,9K)

Kentwood … 1 ($199,9K)

Weatherly … 10 ($109,9K – $204,9K)

Birmingham area homes for sale by general area…

Jefferson County:

Liberty Park/Vestavia … 342

Homewood … 216

Shelby County:

Bluff Park/Hoover/Riverchase … 108

No. Shelby/Hoover … 498

Chelsea … 259

Helena/Pelham … 323

Alabaster/Maylene/Saginaw … 179

Calera/Montevallo/Wilton … 264

In many communities around the greater Birmingham area, the number of homes for sale is down significantly, compared to previous years. This is creating more pressure on people looking to buy a home than in the past, since there are fewer homes to choose from.

David

USDA Pulls Back On Oct. 1st Loan Changes

Good news if you’re looking to buy a home in several areas close to Birmingham…

The U.S. Dep’t. of Agriculture has just announced that a previously planned October 1st change which would have meant the end of federal mortgage funding for two areas in Shelby Co. has been put on hold until late March of 2013.

This latest announcement means that Calera and Chelsea will remain on the list of communities eligible for Buyers to receive USDA funding on home mortgages, at least for another six months.

More than 90 communities nationwide—including Pleasant Grove in Jefferson Co. and areas in Walker and St. Clair counties—had been targeted to lose their eligibility, effective October 1st. Yesterday, however, Dallas Tonsager, USDA’s Under Secretary for Rural Development, issued a notice saying the changes would not take effect next week.

USDA loans are popular with many Buyers because they do not require down payments. They are available, however, only in areas USDA specifically designates.

As it stands now, the changes will take effect March 27, 2013 … unless USDA or Congress takes action in the meantime.

Calera and Chelsea to Lose USDA Loan Coverage

If you’re thinking of buying a home in Shelby County’s Calera or Chelsea area and are planning on financing your purchase with a no-down-payment USDA loan, you better get moving with your purchase, because time may be about to run out.

As of October first, the USDA is expected to update the areas that qualify for its loans. For Shelby Co., this means that Calera—which has long been a popular spot for home Buyers using USDA financing—will be dropped from the eligibility list. Chelsea is also set to be dropped.

In Walker Co., Jasper will be dropped from USDA loan eligibility, as will Moody and Pell City in St. Clair Co., and Pleasant Grove in Jefferson Co.

In all, more than 90 communities will be removed from the list of qualifying areas.

The change in qualifying areas is not a 100% sure thing. At least one U.S. Congressman—Republican Jeff Fortenberry of Nebraska—is pushing to get Congress to order a one year extension of USDA’s existing eligibility zones. Others pushing USDA to grant an extension include the National Association of Realtors, the National Association of Home Builders and the Mortgage Bankers Association.

Why does USDA plan to change the zones? The answer lies partly with the 2010 Census. An existing grandfathering clause allowed any community considered ‘rural’ in 1990 to continue to be eligible for USDA funding until the 2010 Census, as long as it has a population below 25,000 and met other critera. That clause, which was first enacted in 1990 and extended in 2000, is now set to expire.

So, unless Congress takes action, many communities that currently qualify for USDA financing will lose their eligibility—and for many of those areas, USDA loans are the only source of federal housing funding.

David

Jeff De Shazo Joins The Black Team

Colleen and I have some exciting news to pass along…

Jeff De Shazo is joining forces with us to help folks looking to buy homes.

So, just who is this Jeff character, anyway?

With nearly fourteen years as a Realtor—he also holds a Broker’s license—Jeff is no stranger to the Birmingham and Shelby Co. area real estate industry. His knowledge of the business is as solid as you can get.

Jeff has helped individuals and families make real estate purchases throughout the region.

So, why are we joining forces? The answer is pretty simple, actually.

Jeff has always impressed us with his professionalism and friendliness.

When it comes to how we believe Clients should be served, we found that we have so much in common with Jeff that working as a Team just seems to make sense.

In addition to helping with the sales of existing homes, Jeff has several years experience in sales of new homes. That’s especially valuable these days, because there are so many opportunities to buy new homes at unheard of prices.

Jeff is a great source of information if you’ve been thinking of buying a new or existing home in the Birmingham or Shelby Co. area. Whether you’re buying again or for the first time, he’s ready to help.

You can reach Jeff at 205-223-7653, or click here to contact Jeff by e-mail.

By the way … Fisbo, our spoiled six pound poodle, has given Jeff his official seal of approval, as well…

David

New Homes in Birmingham in 120s…

New home prices are getting more attractive all the time. If you doubt that, consider this: In the Shelby Co./Birmingham area, you can have a new home built and pay in the 120s.

For some folks, those prices—coupled with interest rates continuing near all time lows—are just too good to pass up.

Colleen and I thought you’d like a behind-the-scenes look at a new home being built in the Montevallo/Alabaster area.

It’s a good chance to see what your money can buy for you. So, we fired up the video camera and invite you to tag along:

Whether you’re thinking of buying for the first time, or if you’re considering moving, pricing and inventory remain very attractive.

Got questions? Feel free to contact us at 205.677.8696.

Buying a home—whether new or existing—is a big decision, and we certainly recognize that.

Your best decision is always made when you have as much information as possible. We’re happy to help with any questions you have…

David

Birmingham Lender Clears Up Market Myths

If you’re seeing and hearing news suggesting that you’re wiser to hold off on buying a home, a talk with folks knowledgeable about the real estate market in the Birmingham and Shelby Co. area is likely to leave you surprised, and maybe a bit bewildered.

For example:

For example:

Myth: Lenders have stopped lending.

Fact: Lenders are lending, and they have some very good loans available, depending on your situation.

Clearing up the misconceptions is why we decided to catch up with Jason Lee, a Mortgage Banker with Henger Rast Mortgage in Birmingham.

In our latest netcast, we talk with Jason about why what you may be hearing on the news doesn’t match up with what’s happening in the Birmingham and Shelby Co. market.

Click the player just below…and then get moving on buying!

…or click here if you’d like to download and listen to this interview on your personal listening device.

Want to ask Jason a question about getting prequalified? Call him at 205-271-1210, or click here to send an e-mail…

David

Alabaster Area Home Sales Rise in August

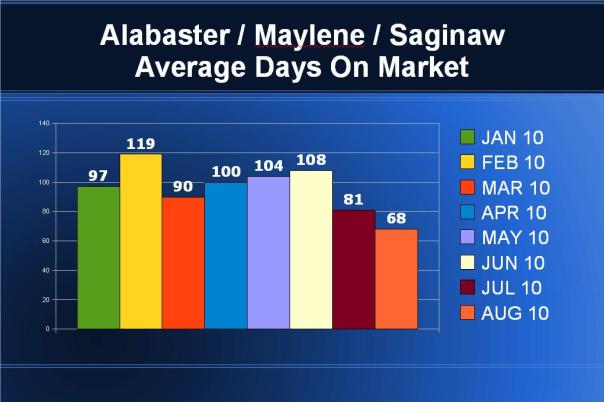

With summer behind us, here’s a look at home sales trends in the Alabaster, Maylene and Saginaw areas (stats from the Birmingham MLS):

After taking a dip in June, average sales prices are holding fairly steady:

How long does it take to get a home sold in these areas? According to the MLS, the time needed is just a little over two months (the shortest it has been all year):

Right now, 354 conventional single family houses and townhomes are for sale in the Alabaster, Maylene and Saginaw areas. Of those:

289 are priced at or below $250,000;

127 are priced at or below $150,000;

22 are priced at or below $100,000;

338 have 3 or more bedrooms;

170 have 4 or more bedrooms;

29 have 5 or more bedrooms;

113 have pools or access to pools;

5 have 4 or more acres…

Need a loan to buy? Rates right now continue to be among the lowest in history. Qualified borrowers can get a 30-year fixed rate loan for as low as around 4.25%; 15-year fixed rate loans can be found by some borrowers as low as 3.75%. Colleen and I have been able to help a number of first time Buyers say ‘adios’ to renting and move into their first homes with some excellent loans at very low rates.

Needless to say, this continues to be a tremendous time to buy a home … let us know if we can help!

David

First Time Buyer’s Closing Deadline Extended

Here’s some great news if you’re one of the folks who’ve been trying to buy a home under the First Time Buyer’s Tax Credit that expired April 30th.

Congress has passed a bill extending the June 30th closing deadline to September 30, 2010. This extension applies for Sales Contracts that were in place as of April 30th, but that had not yet closed. This has affected a lot of people trying to buy, especially folks involved in Short Sales (which take longer, since Lender approval is required).

So, perhaps being patient and waiting for your sale to go through will pay off, after all!

David

First Steps All Home Buyers Must Take

Mar 15

Posted by David Black

Walking on to a new car lot can be fun. You get to see all the latest technology and styling, and imagine yourself behind the wheel.

And then, after glancing at the sticker, reality sets in.

Looking was fun, but the sticker reminds that—before you can actually own that new car—you’re going to have to play the “show me the money” game.

Having your funding secured for the purchase of a new home is just as important. After all, if you don’t have the money needed to make buying a home a reality, what’s the point of looking?

Having enough money on hand to pay cash for a home is great, but let’s face it … not everyone can do this.

The alternative, then, is to get a loan.

Unfortunately, a number of people looking to buy a home in the Birmingham area wind up starting the loan process the wrong way, which goes like this:

The scenario above is a classic invitation to major Buyer disappointment.

It doesn’t have to happen this way.

Colleen and I feel strongly that the first–and most important–steps in the home buying process are to contact us as your Agents and then speak with a Lender.

By finding out how much money you can borrow before you start looking, your search will be easier, as well as more targeted to properties that fit within your price range. If there are parts of your financial background that need work, a Lender can be a good resource for charting a course for you to follow so you can be approved.

If you’re thinking of buying a home, a good Lender will answer all of your questions and make you feel comfortable with the entire process of obtaining financing. Since buying a home is the biggest purchase many people make, if you don’t have this feeling of comfort, our advice is simple: Find another Lender.

Buyers lacking some time of financial qualification may be in for a surprise, given a reality we see all the time in the Shelby Co. and Birmingham real estate market:

Sellers want some assurance that a prospective

Buyer can actually obtain needed funding.

“Show me the money.”

If you try submitting an Offer without including either a loan pre-qualification or verification of funds (if paying cash), many Sellers simply won’t deal with you.

We know of several good Lenders in the Birmingham area with a thorough knowledge of the mortgage profession, different loans, costs and how they work. These Lenders have a strong commitment to providing good service.

Fortunately, most of our Clients purchased their home the right way, having contacted us first and then following our advice on consulting with Lenders before we started helping them with their search.

As a result, they are now happy homeowners.

David

Posted in Commentary, Real Estate

Leave a comment

Tags: agent, alabama, birmingham, colleen black, david black, first time buyer, home for sale, homes, homes for sale, hoover, keller williams realty metro south, lender, loan, market, mortgage, Real Estate, realtor, shelby county